On The Money — Congress eyes sprint to avoid shutdown

Happy Monday and welcome to On The Money, your nightly guide to everything affecting your bills, bank account and bottom line. Subscribe here: digital-release.thehill.com/newsletter-signup.

Today’s Big Deal: Congress is working quickly to pass sweeping legislation to fund the government through the rest of the fiscal year, though sticking points remain. We’ll also look at more momentum behind a bigger-than-usual Federal Reserve rate hike and new sanctions on Russia.

But first, find out which 2020 Democratic presidential candidate is speaking at a major conservative summit.

For The Hill, we’re Sylvan Lane, Aris Folley and Karl Evers-Hillstrom. Reach us at slane@digital-release.thehill.com or @SylvanLane, afolley@digital-release.thehill.com or @ArisFolley and kevers@digital-release.thehill.com or @KarlMEvers.

Let’s get to it.

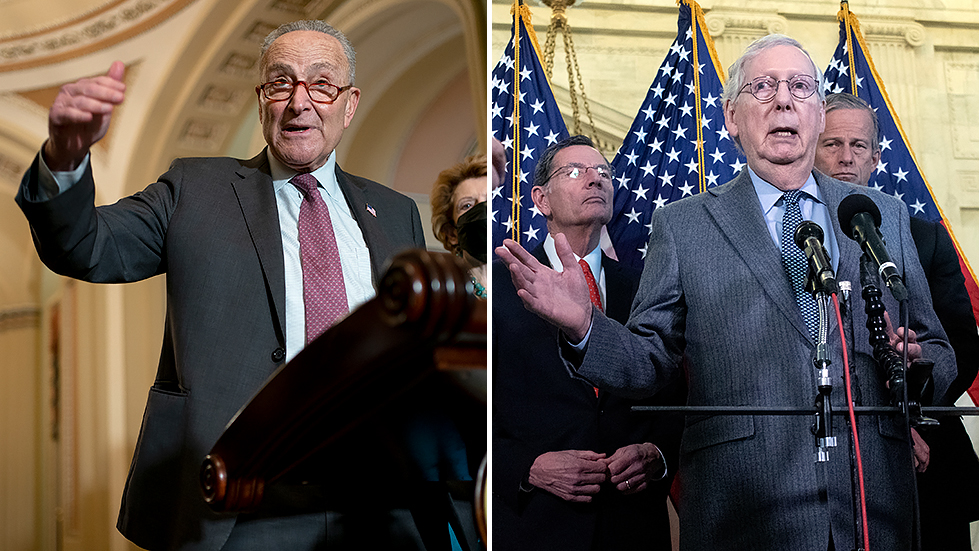

Lawmakers race to finalize funding deal

Congressional negotiators are moving quickly to try to finalize work on a sprawling package to fund the government through the remainder of the fiscal year, though several sticking points remain.

While Congress has made strides in the past few weeks, negotiators have made clear there is still much more work to be done after all 12 Senate appropriations subcommittees recently received new top-line spending numbers for fiscal 2022.

- There are panels that will have an easier time than others in finalizing their portions in the weeks ahead. While some have said Veterans Affairs has been a sticking point in talks, Sen. John Boozman (Ark.), ranking Republican on the Appropriations Subcommittee on Military Construction, Veterans Affairs, and Related Agencies, said his panel has “pretty much got all those things moving in the right direction.”

- But some subcommittees seem to have their work cut out for them. On the Senate Appropriations Subcommittee on Homeland Security, both Chairman Chris Murphy (D-Conn.) and ranking member Shelley Moore Capito (R-W.Va.) say they’re still working toward trying to reach common ground on issues like border wall funding.

- At the same time, top negotiators are fielding more questions about supplemental COVID-19 funds amid reports the Biden administration is eyeing billions more in funds for vaccine and testing efforts, among others.

Lawmakers have roughly three weeks to finish crafting — and ideally pass — a bill to fund the government through Sept. 30, after advancing the latest stopgap last week.

A new omnibus package would afford the Democratic-led Congress and President Biden a major chance to shape government funding for the current fiscal year. Under the continuing resolution passed last Thursday, funding levels are still set at those previously enacted under the Trump administration

Aris has more here.

THE FIGHT AGAINST INFLATION

Fed’s Bowman opens door to larger March rate hike

Federal Reserve Governor Michelle Bowman suggested Monday the central bank could raise interest rates at a faster pace than in previous cycles, as inflation remains “much too high.”

In a Monday speech to a convention of bankers, Bowman said she supported raising rates when the Fed’s monetary policy panel — the Federal Open Market Committee (FOMC) — meets March 15-16.

She added she will be “watching the data closely to judge the appropriate size of an increase,” opening the door to a larger-than-typical rate hike.

- The FOMC is almost certain to raise interest rates next month — almost two years to the day since it slashed its baseline interest range to 0 to 0.25 percent as the emerging COVID-19 pandemic roiled the economy.

- While the Fed usually hikes or cuts interest rates in 0.25 percent increments, some investors expect the bank to raise rates by 0.5 percentage points in March.

“Between now and then, it’s very important that we continue to watch how the economy develops, and understand whether or not things are improving or getting worse as we’re approaching that decision,” Bowman said.

Sylvan has more here.

INITIAL SANCTIONS

Biden to block investment, trade in areas of Ukraine recognized as independent by Putin

President Biden plans to sign an executive order blocking new U.S. investment, trade and financing from flowing into two Russian separatist-held regions in Ukraine after Russian President Vladimir Putin signed a decree recognizing the areas as independent.

After Putin’s authorized Russian forces to invade the Ukrainian territories Monday, the White House told reporters that it would announce additional “sanctions activity” tomorrow.

- The Biden administration has said that it would slap Russia with hefty sanctions if Putin escalated tensions in Ukraine, but it’s unclear whether Monday’s sanctions will make a large impact.

- Substantial sanctions to cripple the Russian economy could dent parts of the U.S. economy, potentially driving up gas prices further.

Read more from The Hill’s Morgan Chalfant.

BE IN THE KNOW

Sign up for NotedDC: Your insider’s pass to the beat of the Beltway. The Hill’s latest newsletter is as fast-paced, provocative and incisive as D.C. itself.

OPTING OUT

IRS allowing taxpayers to opt out of facial recognition technology

The IRS announced Monday that it will allow taxpayers to opt out of using facial recognition technology for identity verification.

Those trying to access their online accounts can instead verify their identity through a live, virtual interview with a representative from a third-party service, ID.me.

- The IRS previously announced that it would transition away from ID.me after lawmakers and digital rights activists pushed back on plans to require facial recognition verification to access tax information.

- Taxpayers will still be able to use the technology for verification if they so choose, though the technology has been found to do consistently worse at identifying people of color.

The Hill’s Chris Mills Rodrigo has more here.

Good to Know

A data leak of Credit Suisse clients shows the bank held millions for heads of state, intelligence officials, sanctioned businessmen and human rights abusers.

A whistleblower sent the information to a German newspaper on more than 18,000 active accounts at Credit Suisse, which collectively hold more than $100 billion.

Here’s what else we have our eye on:

- Truth Social, the social media platform backed by former President Trump, launched in the Apple App Store Monday, although the product does not appear to be fully functional for all users.

- Air France has joined other European airlines in suspending flights to Kyiv on Monday as tensions continue to mount between Ukraine and Russia.

- Mexican President Andrés Manuel López Obrador on Monday repeated calls for the United States to stop funding civil society groups in the country that have been critical of his administration.

- Tourists arrived in Australia for the first time in almost two years on Monday after the country lifted its travel restrictions for fully vaccinated individuals.

- The Dutch antitrust watchdog Authority for Consumers and Markets (ACM) fined Apple 5 million euros, or $5.7 million, on Monday over access to non-Apple payment methods for subscriptions to dating apps.

That’s it for today. Thanks for reading and check out The Hill’s Finance page for the latest news and coverage. We’ll see you Tuesday.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.