Federal aid an overlooked culprit of the college debt trap

An article published in the Washington Post earlier this week by Robert Gebelhoff made some interesting and valid points on the worsening student default situation. Nevertheless, Gebelhoff failed to recognize one of the fundamental drivers of this mounting student debt problem.

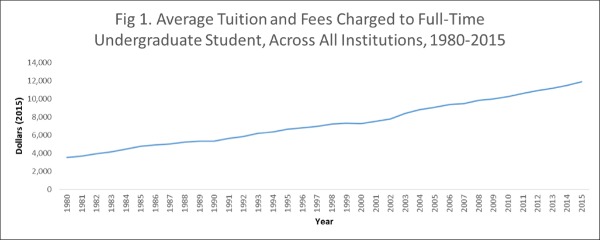

Tuition, in real terms, has more than tripled in recent decades. The average rate of tuition for an undergraduate student has risen from $3,521 in 1980 to $11,865 as recently as 2015.

{mosads}Conventional wisdom suggests that expansions in federal student aid will result in a more affordable and equitable postsecondary education system.

This belief has motivated significant expansions of federal aid for students. However, the available data clearly indicates that increases in federal funding for higher education have actually led to rapidly rising tuition and student loan default rates.

Source: U.S. Department of Education, Digest of Education Statistics: 2016, Table 330.10.

The continuing upward trajectory of gross tuition rates and fees for undergraduate students has increased some 337 percent in constant dollars from 1980 through 2016 — faster even than the rate of increases in health-care prices over the same period.

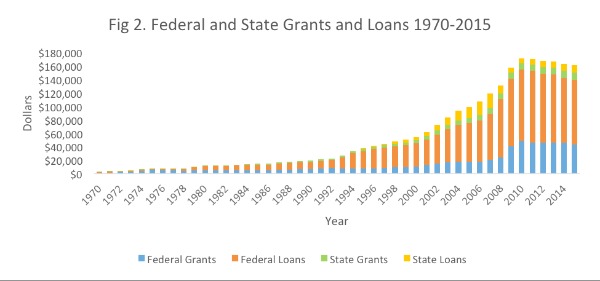

Source: College Board, Trends in Student Aid 2016, table 2.

At the same time, Fig 2. highlights the scale at which government support for higher education in the form of tax benefits, grants and loans has exploded since 1994, and especially since 2000. Grants and loans totaled more than $160 billion in 2015 (constant dollars), up significantly from just over $50 billion in 1994.

Many studies consistently find that increased federal support for higher education leads to a significant increase in tuition and a decrease in institutional aid.

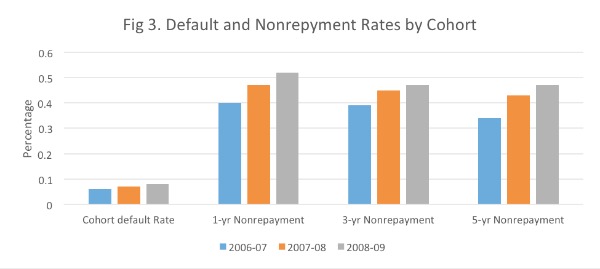

Source: Robert Kelchen et al., “Institutional Accountability: A Comparison of the Predictors of Student Loan Repayment and Default Rates,” (American Academy of Political and Social Science), May 1, 2017.

Different measures of student loan default rates and repayment burdens uniformly show significant increases in recent years, across all types of institutions and students.

Both one-year and three-year cohort default rates have been on the rise since 2005. From Fig. 3 we can also see that holding the number of years after graduation constant, later cohorts have noticeably higher default rates than earlier cohorts.

Some students, particularly from nontraditional backgrounds, seem to have been harmed by the increase in federal funding of student loans. They have not seen increases in their incomes as workers, often do not complete their college program and are more likely to default on their loans, while missing out on job-related income and training.

What’s more, the earnings difference ratio between high school graduates and university graduates over age 25 in full-time work from 1991 to 2016 has remained relatively unchanged since 1991. So, while students are paying more in tuition every year to fund their college education, the value of being a degree holder is no greater today than it was 25 years ago.

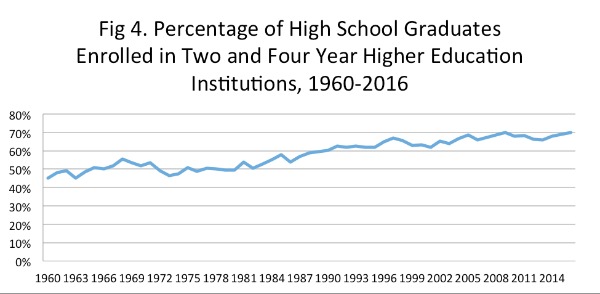

Source: U.S. Department of Education, Digest of Education Statistics: 2016, Table 302.10. Numbers include only civilian population, including those incarcerated.

While it is becoming increasingly clear that the pay-off from acquiring a college education has been in decline for some years, higher education enrollment figures continue to grow.

As Fig. 4 demonstrates, enrollment in higher education, as a percent of the young-adult population and in the supply of college-educated workers as a percent of the workforce, has steadily increased over the past four decades. As of 2016, a record 70 percent of recent high-school graduates are enrolled in some form of higher education.

Further increases in federal support for higher education are not needed and indeed are likely to be counterproductive because they lead to higher tuition for all students.

Recent empirical studies have concluded that increased federal funding alone could account for a 102-percent net increase in tuition between 1987 and 2010. Another study from 2015 found a large “pass-through” effect on tuition prices from subsidized federal student loans.

The resultant increase in tuition, decline in average student quality and increase in student loan defaults should lead policymakers to question whether the massive increase in federal support for higher education is achieving its goals.

A robust parallel system of on-the-job training, apprenticeships and youthful practical work experience is needed, supported by changes in federal laws and regulations, such as lowering the minimum wage for younger workers.

Jack Salmon is a Washington, D.C.-based researcher focused on federal fiscal policy. Salmon holds an M.A. in political economy with specializations in macroeconomics and comparative economic analysis from King’s College London.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.