Don’t let the Fed scare us into a recession

A recent article in The Hill described how, despite current excellent growth rates, a growing number of economists believe the U.S could enter a recession in 2020. As the article points out, such forecasts are very uncertain, but because it takes about a year for monetary policy to take effect, an emerging sentiment among some economists is that the Fed will screw up policy in the year ahead.

Why would economists think such a thing? Because the Fed has essentially announced an intention to do just that. Chairman Jerome Powell, a normally savvy financial observer (and former colleague of the author) stated on Oct. 3 interest rates “are a long way from neutral,” and “We may go past neutral.”

Risky plans for large interest rate increases seem driven by adherence to a failed economic theory, the Phillips Curve, that postulates changes in the unemployment rate determine inflation. In fact, there is no consistent Phillips relationship; what’s more, inflation is quiescent and has been turning down, the economy is expected to slow next year, and the financial markets, which have been more accurate than the Fed, are telling us rates are practically at neutral now.

{mosads}In 1958, a New Zealand economist, William Phillips, identified an inverse relationship between unemployment and inflation: as unemployment increased, inflation decreased, and vice versa. His work was elaborated upon by legendary economists Paul Samuelson and Robert Solow in the early 1960s, but late 1970s “stagflation” — the era’s combination of both high unemployment and high inflation — discredited the Phillips relationship.

There have been episodic correlations since, but basic statistics preaches “Correlation does not mean causation.” Overall, there is no significant relationship between unemployment and inflation, except for services prices, which, being labor intensive, do show a weak but consistent relationship with unemployment. Complex global supply chains and floating foreign exchange rates are among factors cited for the diminished Phillips relationship.

Despite its shortcomings, the Phillips curve continues to have adherents in academic economics and its central bank offshoots, perhaps for lack of better alternatives. Its recent ineffectiveness provides no grounds for excessive interest rate increases.

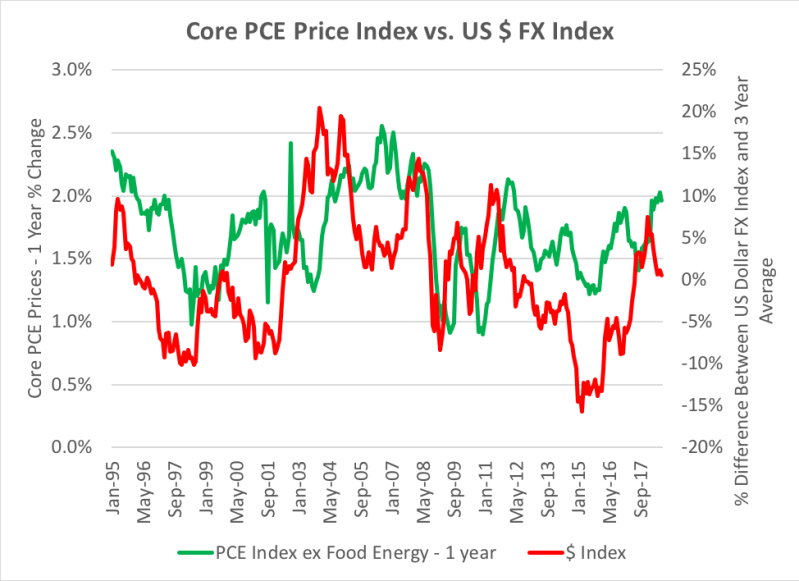

In fact, since 1995, inflation has been remarkably stable. The Fed’s preferred inflation measure, Personal Consumption Expenditures Prices Excluding Food and Energy (core PCE), has varied from 0.9 percent to 2.6 percent with no long-term trend. Fluctuations around the average of 1.7 percent are largely attributable to variations in the foreign exchange value of the dollar, explaining over a third of core PCE movements and over half the movement of the more volatile headline PCE measure that includes food and energy prices.

Courtesy of the author

In 2017, core PCE prices rose a below average 1.6 percent, following the dollar’s appreciation after Donald Trump’s 2016 victory. The dollar slumped through late 2017 and early 2018, leading to current yearly core PCE inflation of 2.0 percent, but, since the dollar bottomed in April, the last three months have seen core PCE inflation of just 1.4 percent. That means inflation is well under control, with no indication of breaking out from its over 20-year range. There is no reason based upon inflation for the Fed to increase rates beyond neutral.

The projected path for the economy into 2019 is yet another reason the Fed should maintain a neutral policy with limited interest rate increases. The Fed’s own projections call for growth to slow from 2.8 percent this year to 2.4 percent in 2019 as initial stimulus from the Tax Cut and Jobs Act diminishes. Recently slowing of homebuilding and automobile production seem to confirm this forecast. Again, no reason to overtighten.

A published technical paper describes how to read the bond market’s expectations for future neutral interest rates. Currently those expectations range from 2.88 percent to 3.05 percent, not far from the Fed’s current interest rate target range of 2.00-2.25 percent. Chairman Powell’s comments increased these expectations by 0.10 percent, so they may well settle down again. In any event current rates are close to neutral.

Every post-World War II U.S. recession has been preceded by significant increases in the target Fed Funds interest rate. Recessions also have been preceded by increases in inflation, and that is not now the case. Slowing inflation and growth and financial market expectations all argue for limiting rate increases to below 3.00 percent.

Famous economist John Maynard Keynes said “Practical men … are usually the slaves of some defunct economist.” Let’s hope the Fed is practical and not enslaved to a defunct Phillips curve that could lead the U.S. into recession.

Doug Carr is president of investment management firm Carr Capital Co. and an associate fellow at R Street Institute, a policy research think tank in Washington, D.C.

Copyright 2023 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.